What is IRS office in Cincinnati Ohio? Internal Revenue Service P. Department of the Treasury. Pennsylvania Avenue, NW Washington, D. This revenue consists of personal and corporate income taxes, excise, estate, and gift taxes, as well as employment taxes for the nation s Social Security system. National Recognition.

Any payment or tax form sent to those PO Box addresses will be returned to sender. ALS is the system used to maintain lien documents. The Bureau of the Fiscal Service provides international payment services to federal agencies allowing payments to be made in 1currencies in more than 2countries. ACC MISC at Independence University.

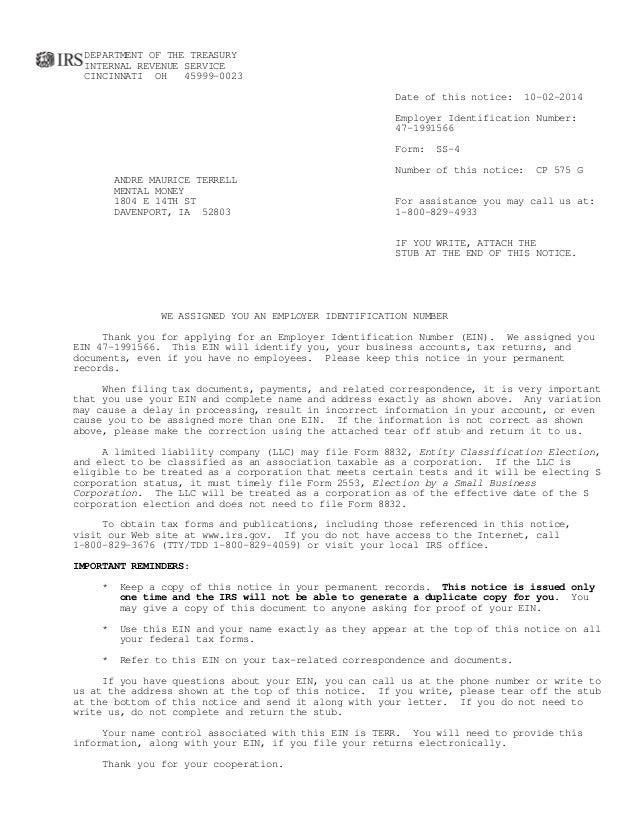

DEPARTMENT OF THE TREASURY. Gribben was appointed commissioner of the U. The new commissioner was charged with collection of taxes on alcohol and tobacco. Make your check payable to the United States Treasury. Write your Social Security number, the tax year, and the form number on your payment and any correspondence. INTERNAL REVENUE SERVICE.

IF YOU WRITE, ATTACH THE. Number of this notice: CP 5E. STUB AT THE END OF THIS NOTICE. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

Mnuchin is responsible for the U. Treasury , whose mission is to maintain a strong economy, foster economic growth, and create job opportunities by promoting the conditions that enable prosperity at home and abroad. Treasury ’s Mission Treasury ’s mission highlights its role as the steward of U. Thank you for your question. DLN: xxxxxxxxx Contact Person: XXXX XXXXX. Except for taxpayers who live abroa the extension may be for no more than months. Our goal is to help make your every experience with our team and Ohio ’s tax system a success.

The mailing address to send Form 941-X depends on where you are located. Step 2) Important: Turn OFF address verification. Form 990-N, e-Postcard (available online only) Additionally, you may be required to file your annual return electronically. If an organization required to file a Form 990.

A copy of this letter should be attached to the form. The rulings contained in this letter are based upon information and representations submitted by the taxpayer and accompanied by a penalty of perjury statement executed by an appropriate party.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.